Blog

Mark Your Calendars: 2023 Tax Season Starts on January 29th

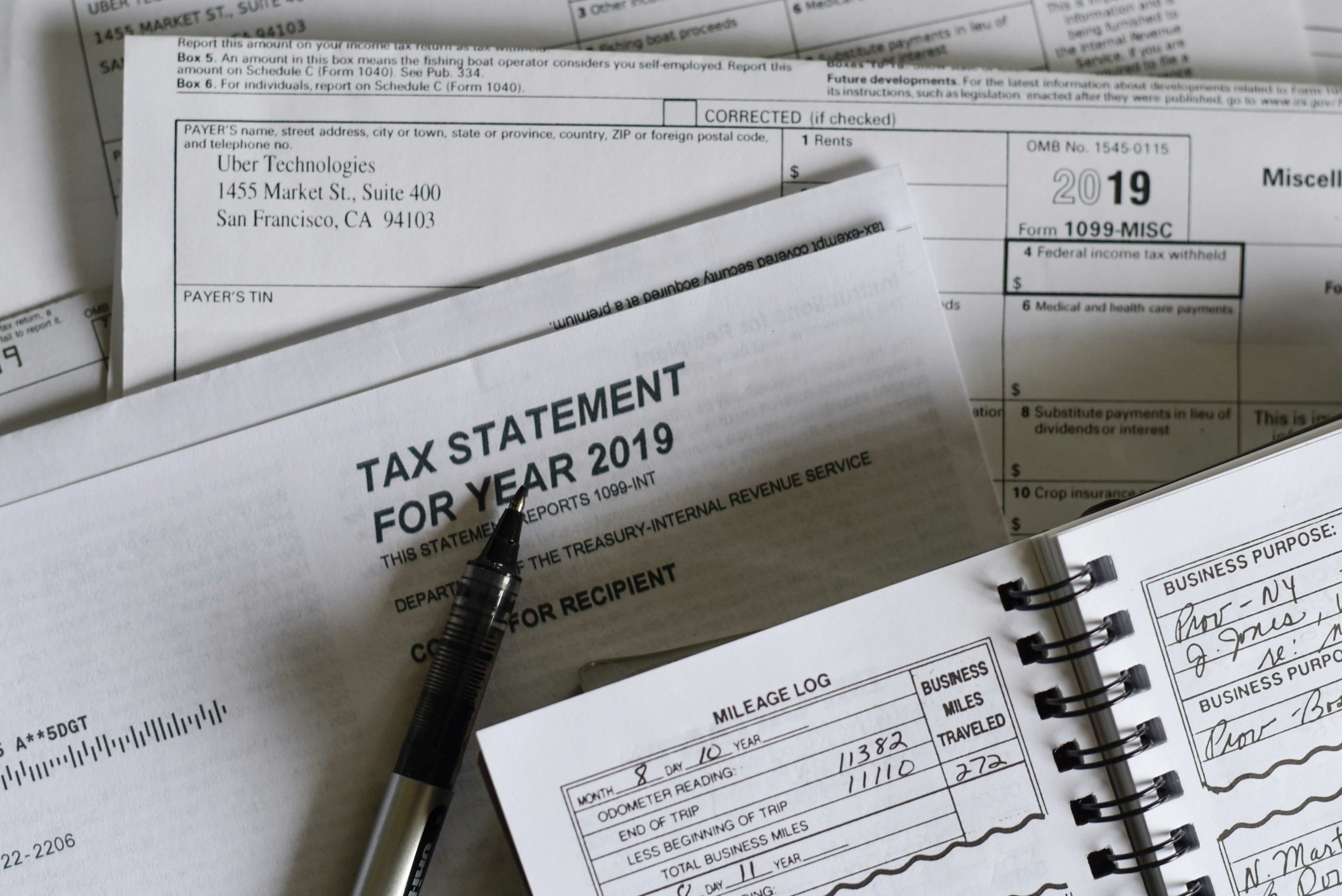

It’s that time of year again when taxpayers eagerly await the start of the tax season. The Internal Revenue Service (IRS) has officially announced the kick-off date for the 2023 tax season: January 29th. This marks the first day the IRS will begin processing tax returns. While this date may vary slightly from year to year, it’s crucial information for both taxpayers and tax preparers.

Changing Start Dates

Changing Start Dates

Each year, the start date of the tax season may shift slightly. For comparison, last year, it began on January 23rd. This variance means that tax preparers will have slightly less time to process returns, making efficient and timely filing all the more important.

Filing Early: Myths and Realities

There’s a common belief that filing your taxes early in the season increases your chances of being audited. The theory behind this is that the IRS, at the beginning of the season, has a smaller pool of returns to review. However, it’s essential to note that there is no concrete data to support this claim. The IRS conducts audits based on various criteria, and the timing of your filing alone is unlikely to be a determining factor.

That said, there are legitimate reasons why some taxpayers prefer to file early.

1. Quick Access to Refunds:

Many individuals who anticipate a refund opt to file early to expedite the process and access their refund sooner. This can provide a much-needed financial boost, especially after holiday expenses.

2. Child Custody Disputes:

Parents involved in custody disagreements often want to claim their child first on their taxes to qualify for the child tax credit. Filing early can help secure this benefit.

Caution for 1099-B Filers

While filing early has its advantages, there’s a word of caution for those who receive 1099-B statements, typically issued by financial institutions. It’s not uncommon for these institutions to reissue amended 1099-B statements after sending the initial ones. If the information on these statements changes, it could necessitate amending your tax return to reflect the updated numbers accurately.

In conclusion, mark January 29th on your calendar as the official start of the 2023 tax season. While there’s no need to worry about filing early leading to an audit, it’s essential to understand why you want to file early and be aware of any potential complications, especially if you receive 1099-B statements. As always, consulting with a tax professional can provide valuable guidance and ensure a smooth tax-filing experience. So, get ready to tackle your taxes and make the most of the upcoming season.